How to Trade Crypto Using AI?

This article aims to provide an overview of the fundamentals of cryptocurrency trading, including the various types of trading and how technology is transforming this landscape.

It will outline the process for engaging in cryptocurrency trading and offer practical steps for getting involved in AI-driven crypto trading.

Additionally, the article will address the risks associated with this venture, highlight common mistakes to avoid, and explore the future of the rapidly evolving field of cryptocurrency trading.

Contents

- Key Takeaways:

- What is Crypto Trading?

- What is AI in Crypto Trading?

- How to Get Started with AI Crypto Trading?

- What Are the Risks of Using AI in Crypto Trading?

- What Are the Common Mistakes in AI Crypto Trading?

- What Are the Future Trends in AI Crypto Trading?

- Frequently Asked Questions

- What is AI and how does it relate to crypto trading?

- How can AI benefit my crypto trading strategy?

- Do I need programming skills to use AI for crypto trading?

- Can I trust AI to make accurate trading decisions?

- How much does it cost to use AI for crypto trading?

- Is it possible to lose money when trading crypto with AI?

Key Takeaways:

What is Crypto Trading?

Crypto trading involves the buying and selling of digital assets, primarily cryptocurrencies like Bitcoin and Ethereum, through platforms known as cryptocurrency exchanges, such as Binance, Kraken, and Kucoin.

The crypto trading market is a dynamic environment that requires analysis of price movements, market trends, and trading opportunities, enabling traders to employ various strategies to optimize their performance and returns.

This sector has rapidly evolved, attracting both retail and institutional investors who utilize advanced trading tools and algorithms, ultimately shaping the future of financial transactions.

What are the Types of Crypto Trading?

There are several types of crypto trading, including day trading, swing trading, scalping, and automated trading, each tailored to different trading styles and risk profiles.

Day trading involves executing numerous trades within a single day to capitalize on short-term price fluctuations, while swing trading focuses on profiting from longer-term movements over days or weeks.

Automated trading and algorithmic trading employ complex algorithms and AI trading bots to execute trades automatically based on predefined criteria, enabling traders to seize opportunities while reducing emotional decision-making.

Scalping is characterized by extremely short-term trades, typically lasting only a few minutes, to take advantage of small price movements. This strategy demands intense focus and rapid decision-making but can yield substantial profits when executed correctly.

Each trading type comes with its own advantages and disadvantages. Day traders can quickly respond to market changes but face higher volatility and trading fees, whereas swing traders can benefit from larger market trends but must contend with overnight price fluctuations.

Successful cryptocurrency trading also necessitates robust risk management strategies to preserve profits and minimize losses, ensuring that traders maintain disciplined trading patterns despite the market’s unpredictability.

What is AI in Crypto Trading?

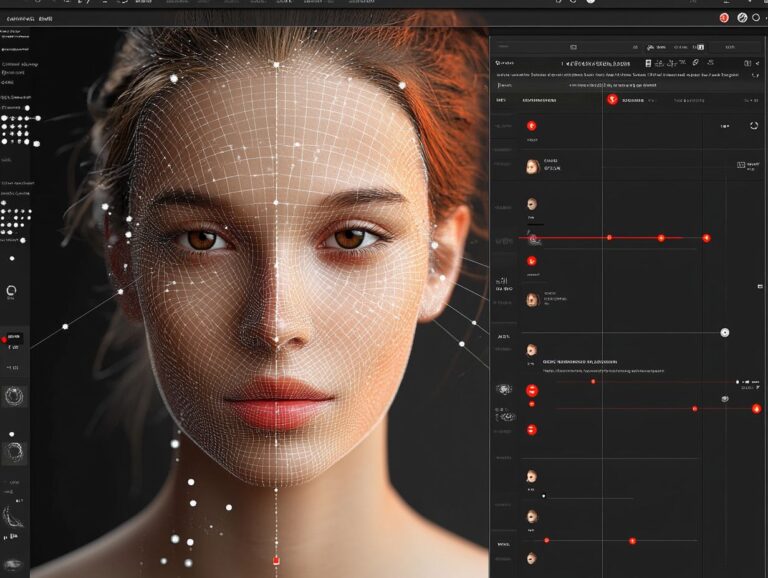

AI in crypto trading involves the application of artificial intelligence technologies, such as machine learning, natural language processing, and deep learning, to analyze market data and make better trading decisions.

AI trading bots utilize these technologies to optimize trading algorithms, generate trading signals, and execute trades on behalf of users, based on real-time sentiment analysis and current market conditions.

By integrating AI capabilities, traders can enhance their trading efficiency, mitigate risks, and improve their overall performance in the fast-paced cryptocurrency markets.

How Does AI Work in Crypto Trading?

AI enhances crypto trading by utilizing sophisticated machine learning algorithms that analyze vast volumes of transaction data and identify patterns in price fluctuations. Traders take advantage of these findings to inform their decision-making processes.

These advanced algorithms not only examine historical price information but also incorporate sentiment analysis from social media and news outlets, which can significantly influence market activity. By evaluating a wide range of parameters, including trading volume and volatility, AI trading bots can generate accurate predictions about future market movements.

Furthermore, AI trading systems employ the latest technologies to continuously learn from new data inputs, adjusting their strategies as necessary to adapt to changing market conditions. This combination of comprehensive market analysis and adaptive learning allows traders to remain competitive and make informed decisions, ultimately leading to superior trading performance and minimized risks.

What Are the Benefits of Using AI in Crypto Trading?

The use of AI in cryptocurrency trading offers several benefits, including increased trading efficiency, enhanced risk management, and improved overall trading performance. AI trading bots can execute trades with high speed and precision, enabling traders to take advantage of fleeting market opportunities without the delays associated with manual execution.

Additionally, AI can assess risk parameters, provide insights into market volatility, and suggest optimal trading strategies that align with individual risk tolerance and investment goals. By leveraging advanced algorithms, these AI systems can analyze vast amounts of market data and identify patterns that may not be apparent to human traders.

For instance, through machine learning techniques, AI can predict price movements based on historical trends and real-time information, facilitating timely trades that maximize profit. Furthermore, AI-driven systems can continuously monitor market conditions, allowing for immediate adjustments to protect investments against sudden price fluctuations.

This not only streamlines the trading process but also enhances overall performance by minimizing human error and emotional decision-making during volatile market conditions.

How to Get Started with AI Crypto Trading?

The first step in embarking on AI crypto trading is to select AI trading bots and platforms that provide automated trading strategies aligned with your goals. Begin by seeking out reputable trading platforms that offer robust AI trading software.

These platforms should allow you to customize your trading parameters, such as profit and loss targets and trade execution frequency. Additionally, look for platforms that offer a diverse range of cryptocurrencies for trading.

Next, take the time to familiarize yourself with the features of these trading tools and the specific crypto markets they support. This will help ensure that you have a diversified portfolio that aligns with your trading objectives.

What Are the Best AI Crypto Trading Platforms?

The top AI crypto trading platforms include Binance, Kraken, and Kucoin. These platforms are recognized for their extensive range of tools and AI trading bot software, which help optimize trading strategies.

The best crypto trading platforms offer seamless access to cryptocurrency markets, advanced trading software, and customizable solutions tailored for both novice and experienced traders.

How to Choose the Right AI Trading Strategy?

Choosing the right AI trading strategy involves determining trading goals, assessing risk appetite, and analyzing market conditions to select the most suitable automated trading strategies. When selecting AI trading bots, factors such as the past performance of trading algorithms, current market trends, and the characteristics of the digital assets in question should be carefully considered.

By aligning automated trading strategies with their own trading goals and objectives, traders can enhance their trading results and effectively manage their personal investment portfolios.

Here are some key considerations to keep in mind during this process:

- Assess the Reliability and Adaptability: Understanding how different strategies have performed across various market cycles can provide traders with insights into their reliability and adaptability.

- Portfolio Diversification: Traders should seek strategies that diversify their existing positions while effectively managing risk.

- Trade Frequency: It is important to consider the number of trades the algorithm executes daily and its responsiveness to real-time data. Algorithms that trade too frequently may incur excessive transaction fees without delivering significant returns, while those that are less responsive might miss out on profitable opportunities.

- Balance Between Short-Term and Long-Term Gains: Traders should evaluate the trade-offs between short-term and long-term gains to maximize their overall returns.

Additionally, it is essential to periodically review the automated trading strategies being employed to ensure they remain aligned with the trader’s evolving trading environment.

What Are the Risks of Using AI in Crypto Trading?

AI in crypto trading offers numerous advantages, but it also comes with certain risks, such as reliance on algorithms, market volatility, and the potential for AI trading bots to generate inaccurate trading signals.

The inherently volatile nature of cryptocurrency markets can lead to unpredictable price movements, which may cause automated trading strategies to falter. Therefore, traders should exercise caution and implement robust risk management measures to mitigate these risks.

How to Minimize Risks in AI Crypto Trading?

The risks associated with AI crypto trading can be minimized through effective risk management strategies. These strategies include:

- Setting stop-loss orders

- Diversifying asset allocation

- Conducting regular performance reviews

Trading bots equipped with adaptive algorithms can adjust their signals based on real-time market data, enabling a more responsive approach to sudden price fluctuations. Traders can further reduce risk by spreading their investments across a variety of cryptocurrencies, which helps mitigate potential losses from market volatility.

Stop-loss orders allow traders to set automatic exits when market prices reach predetermined levels, protecting them from excessive losses. Additionally, continuous performance reviews are essential for traders; by comparing their performance against key performance indicators (KPIs), they can ensure their strategies align with their objectives and adapt to changing market conditions.

Keeping abreast of market news and utilizing analytical tools can also provide traders with valuable data, aiding them in making informed decisions that align with their risk profiles.

What Are the Common Mistakes in AI Crypto Trading?

Common mistakes in AI crypto trading include over-reliance on AI trading bots, neglecting market analysis, and allowing emotional decision-making to influence trading strategies.

Traders often set unrealistic expectations for their AI bots, which can result in disappointment when the performance does not align with their initial projections. Additionally, failing to adapt to changing market conditions can lead to missed opportunities, underscoring the importance of continuous learning and adjustment in trading practices.

How to Avoid These Mistakes?

Avoiding common mistakes in AI crypto trading requires a commitment to continuous learning and a disciplined approach to trading strategies. Traders should prioritize their education by participating in webinars, tutorials, and trading communities to enhance their understanding of market trends and trading tools.

By maintaining self-awareness and critically evaluating their emotional responses to market fluctuations, they can reduce impulsive decisions that often result in losses. Implementing a robust risk management strategy will help protect against significant downturns, allowing them to sustain their trading journey even in volatile markets.

Additionally, staying informed about technological advancements in AI can provide traders with fresh insights, enabling them to adapt their strategies to evolving market dynamics.

What Are the Future Trends in AI Crypto Trading?

Future trends in AI-driven crypto trading are expected to evolve significantly, propelled by advancements in blockchain technology, machine learning, and trading algorithms.

As the cryptocurrency markets mature, we can anticipate greater integration of AI trading bots with enhanced functionalities, resulting in more sophisticated trading strategies. Additionally, trends such as real-time sentiment analysis and deep learning will play a crucial role in shaping the future landscape of crypto trading, offering traders unprecedented insights into market dynamics.

What Are the Potential Risks and Rewards?

The risks and rewards of AI crypto trading are closely intertwined, presenting opportunities for profit alongside the inherent risks of market volatility. While AI trading bots can enhance trading performance and automate trading strategies, they also expose traders to the fluctuations of the market, which can lead to losses. Therefore, understanding and mitigating these risks while maximizing the rewards is essential for successful trading in the rapidly evolving cryptocurrency marketplace.

Traders utilizing AI technology must recognize that the volatility inherent in the cryptocurrency space can significantly impact the performance of a trading bot. Factors such as sudden shifts in market sentiment, regulatory changes, or macroeconomic events can render even the most sophisticated AI trading tools inaccurate in their predictions and analyses. For instance, an AI trading bot that is well-configured to capitalize on short-term trends in a bullish market may struggle during a bear market.

However, by implementing robust risk management strategies such as stop-loss orders and portfolio diversification traders can minimize the potential risks associated with AI-driven crypto trading. Regularly analyzing trading performance and metrics can provide insight into the bot’s effectiveness, enabling traders to adjust their strategies and optimize their gains in an ever-changing cryptocurrency market.

Frequently Asked Questions

What is AI and how does it relate to crypto trading?

AI, or artificial intelligence, is a technology that allows computers to make decisions and perform tasks without human intervention. In crypto trading, AI can be used to analyze market trends and make predictions on which assets to buy or sell.

How can AI benefit my crypto trading strategy?

AI can benefit your crypto trading strategy by providing valuable insights and data-driven recommendations. It can analyze large amounts of data and make informed decisions in a fraction of the time it would take a human trader.

Do I need programming skills to use AI for crypto trading?

No, you do not need programming skills to use AI for crypto trading. There are AI-powered trading platforms and tools available that can be used by traders of all levels, regardless of their technical background.

Can I trust AI to make accurate trading decisions?

AI is constantly learning and improving, so its accuracy in making trading decisions can vary. It is important to keep monitoring and adjusting its strategies to ensure optimal performance. It is also recommended to use AI as a tool and not rely solely on it for all trading decisions.

How much does it cost to use AI for crypto trading?

The cost of using AI for crypto trading can vary depending on the platform or tool you choose. Some platforms may offer free trials or low-cost subscriptions, while others may charge a percentage of your profits. It is important to research and compare different options to find the best fit for your budget.

Is it possible to lose money when trading crypto with AI?

As with any trading strategy, there is always a risk of losing money. While AI can provide valuable insights and recommendations, it is not infallible and cannot guarantee profits. It is important to have a solid understanding of the market and to use risk management strategies when trading with AI or any other method.